Carson City Transportation Manager Chris Martinovich addresses road funding at the Sierra Nevada Forums discussion April 9, 2024 at the Brewery Arts Center.

Photo by Adam Trumble.

Figuratively speaking, it was a long road that led two Carson City officials to discuss an estimated $21 million road-funding deficit in front of an audience at the Brewery Arts Center on Tuesday.

Carson City Public Works Director Darren Schulz and Transportation Manager Chris Martinovich took turns detailing the source and history of the problem and potential solutions. They spoke as guests of Sierra Nevada Forums, which are organized with the American Association of University Women and the League of Women Voters of Northern Nevada and are co-sponsored by the Nevada Appeal.

Martinovich and Schulz said the problem, according to inventories of the city’s roadways, is the road network will continue to deteriorate without new funding sources. Though all roads are affected by the annual shortfall, including regional arterials and collectors that qualify for federal funding, local neighborhood streets will bear the brunt of worsening conditions.

According to Public Works, 17.9 percent of neighborhood streets are in very poor pavement condition, and .8 percent are considered failed. Following the department’s projections, 75 percent of neighborhood streets will be very poor and 5.6 percent in a state of failure by 2050.

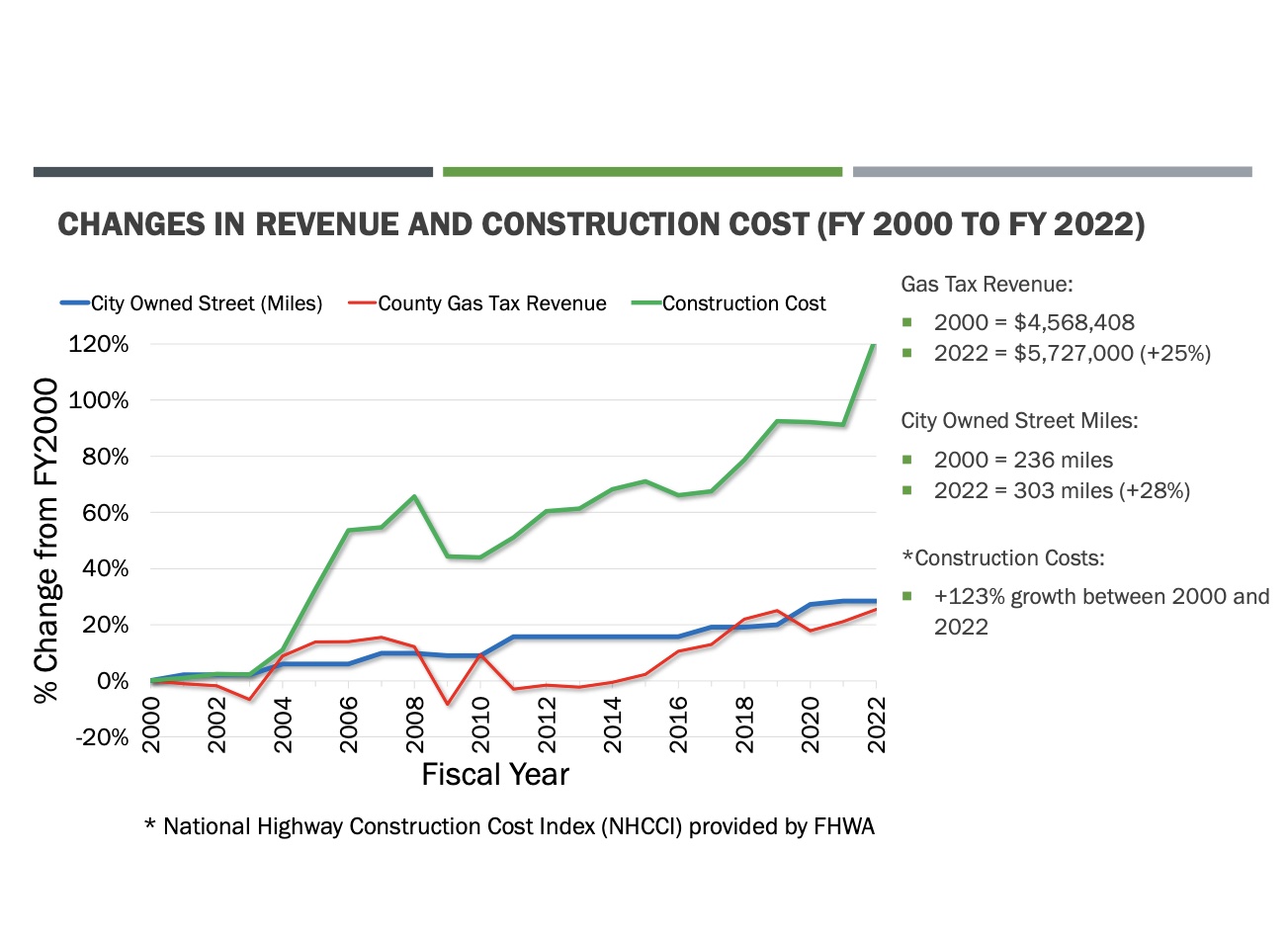

Martinovich said a failed road is essentially a “glorified gravel road.” He and Schulz made the case the city has not ignored the problem but tried to address it with past action. The source of the problem, they said, is road construction costs have far exceeded fuels and sales taxes set in place decades ago. A graph they provided showed gas tax revenue growing by 25 percent from 2000 to 2022 and construction costs growing by 123 precent in the same time.

A graph from Carson City Public Works showing road construction costs surpassing gas tax revenue from 2000 to 2022.

Martinovich put current road construction costs at over $2 million a mile for reconstruction and $380,000 a mile for preventive work like slurry seals.

“You can see the cost of doing the same things is costing more than it did in 2000. And that’s really the crux of the problem is that our revenue isn’t keeping up with the costs of construction,” he said.

Public Works has maintained the funding shortfall exists between an estimated $25.5 million needed to keep the road network in its current condition and approximately $4.5 million available for road maintenance every year. The department’s streets division performs a variety of tasks besides street maintenance: snowplowing, street sweeping and work on curbs, gutters and sidewalks, all of which costs money.

“What does $4.5 million get us?” Martinovich asked of road work.

The answer was very little. Of 286 paved miles owned by the city – 203 miles of neighborhood streets and 83 miles of regional road – the $4.5 million in fiscal year 2022 went to 3.9 miles of regional road, Martinovich pointed out.

Schulz broke down existing taxes, emphasizing the funding issue is not new. The city’s current gas tax of 15.35 cents per gallon is comprised of 5.35 cents mandated by the state, 4 cents authorized in 1977, 1 cent authorized in 1986, and 5 cents authorized in 1997. A 5 cent-per-gallon diesel tax was approved by voters in 2022. Furthermore, a .25 percent sales tax for street maintenance was passed by voters in 1986, contributing a small percentage to the city’s overall sales tax rate of 7.6 percent.

“I just kind of looked approximately over the last 10 years because I don’t want anybody to think that this is a new problem,” Schulz said of discussion surrounding the funding gap, “and I don’t want anybody to think that this is the first time we’ve brought this forward and we’ve discussed it because that’s just not the truth … The funding issue has always been there, but it’s definitely gotten worse over the last 10 or 15 years.”

In 2015, Schulz said, the Board of Supervisors directed staff to create a working committee of residents to develop funding solutions. The work involved several meetings, back and forth with supervisors, and the result was to place fuels tax indexing measure (not to exceed 3 cents a gallon each year) on the 2016 ballot to keep pace with inflation.

That measure would have raised $40 million for local roads over 10 years, according to the ballot question.

“That ballot measure did not pass in Carson City,” Schulz said.

2016 was a presidential election year, and approximately 66 percent of the active electorate voted against the indexing measure.

After the presentation Tuesday, audience members asked some pointed questions.

“What is the city doing to cut nonessential expenses to find new funds to spend on roads before asking taxpayers, again, to pay more new taxes?” was one question read by forum moderator Greg Novak, a member of the Regional Transportation Commission.

Schulz said supervisors have used general fund savings for road funding in recent years. He told the Appeal street funding saw about $700,000 from the general fund in fiscal year 2021 and roughly the same amount the following year.

“Generally, that’s just balancing the other services that the city provides,” he told audience members. “Our biggest expenditure, I think most people know this, is the funding of staff and services as it relates to our police department and our fire department. So, when you start looking at where could we move money and put it into roads, it doesn’t take long to where we start affecting … whether it be parks, whether it be sheriff, whether it be fire, whether it be health. Those types of services make up the majority expense of our general fund. So, if we’re going to start moving money, those are the types of things that would be affected.”

One question asked if the city could handle, operationally and staff-wise, a hypothetical doubling of road revenue.

“From a design and construction management side of things, we couldn’t handle it,” said Martinovich, “so we would be looking to hire design companies to help us design projects.”

Martinovich added that current staff would seek efficiencies in projects where possible.

Further discussion touched upon a city-wide general improvement district – a fundraising mechanism explored but not finalized – and a new .25 percent sales tax and supplemental governmental services tax proposed for the November ballot.

The latter two tax proposals were approved by the RTC in March with the restriction any new funding be applied to neighborhood streets. At the time, the city estimated the proposals could raise $6.5 million in new revenue for roads. Supervisors are expected to review the ballot measures at their April 18 meeting.

To view the presentation go here